Towards better financial management in Malaysia

Spot check, do you have enough to retire? Just some personal thoughts on financial literacy in our country.

I classify myself as an amateur when it comes to financial literacy. How about you?

I only started to learn about savings and investment a few years ago, the long term gain from EPF/KWSP, how to diversify your money to make it work for you rather than letting it sit quietly in the bank (or the coinbox at home). TBH, there was a time where I thought throwing more money at a mortgage repayment will help me save money overtime, only to find out that I should weight the savings from this extra repayment against potential gains from investing the extra money instead.

I really wish there were more accessible day to day tools that can educate and help us with knowing what best to do with our finances. In this post, I'd like to share the few banking apps that has helped me be more aware of my savings and spending habits. I believe having the awareness of your financial habits and status is a good start to making better financial decisions

Nope, this is not an affiliate marketing post for any of the apps mentioned below.

1.Monzo Digital Banking app (UK)

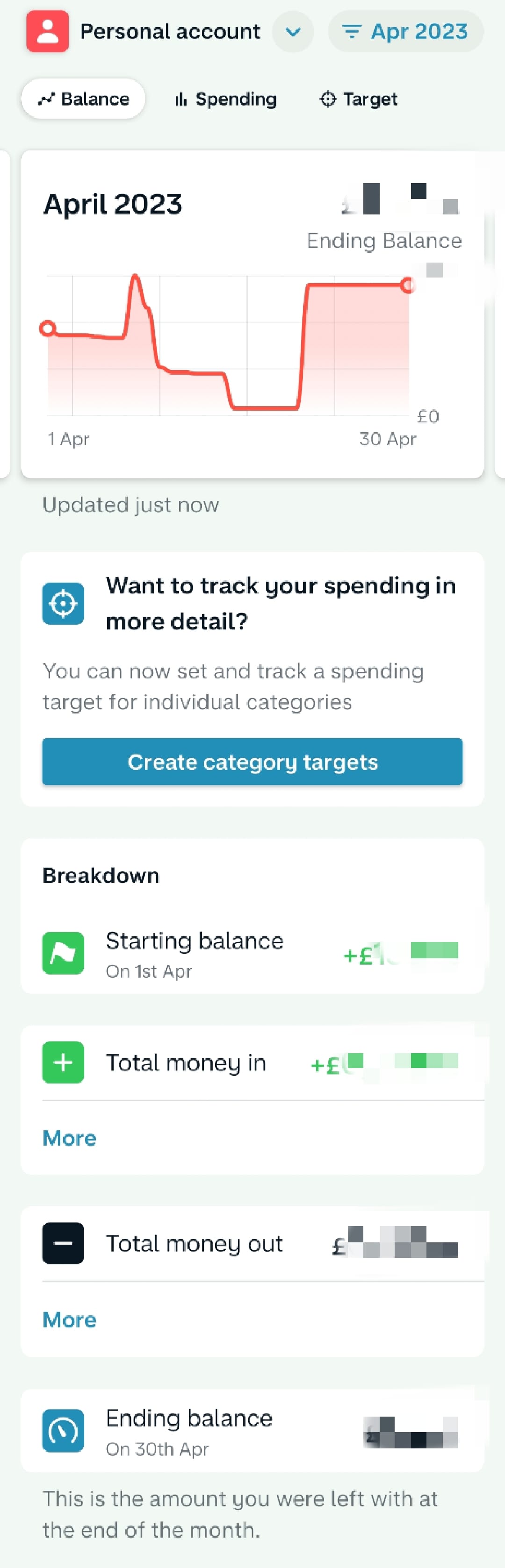

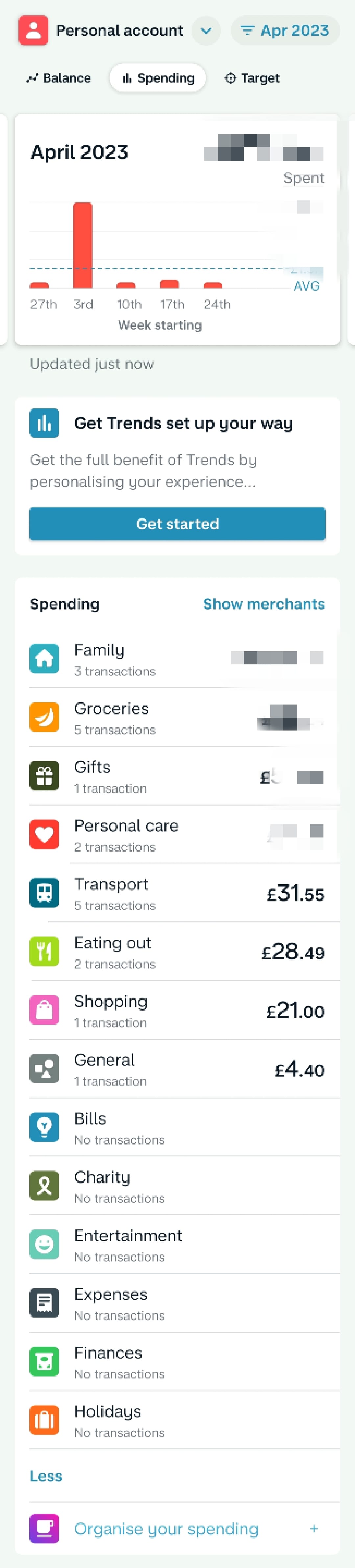

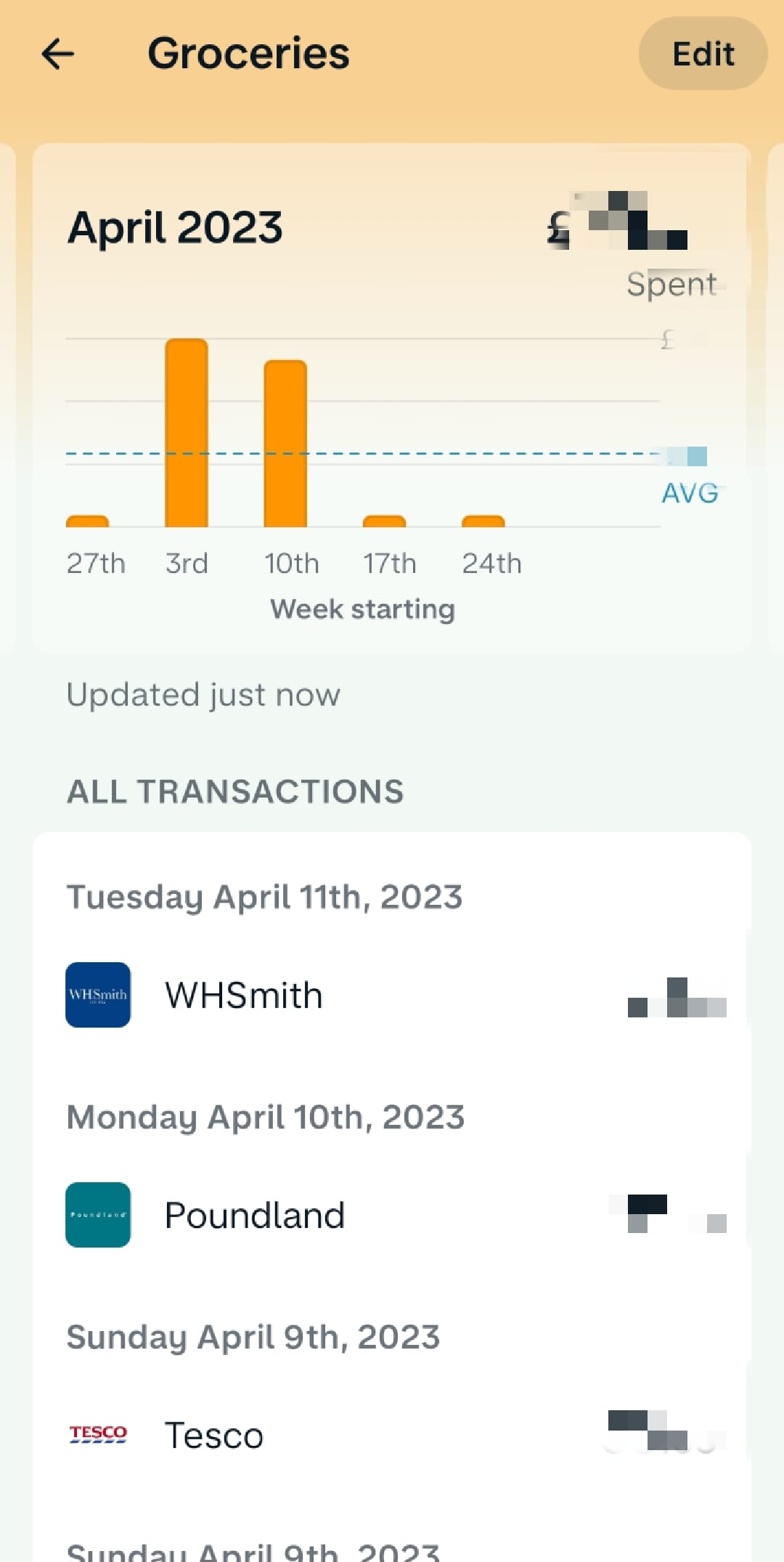

This was an app I registered for when I was a student in the UK. What I like most about the app is the fact that it categorises my spending every month. You can click on each category to view the merchants you have spent money on too! This helps me observe what I spend money on the most, be it eating out, transport, or groceries. And on months where there are special occasions, at least this helps justify one-off spending I have made.

With the app, it also gives you a general breakdown of money in and out each month. And with the year/month calendar, you can also reflect on your spending across time, even the ones years back!

Screenshots from Monzo app

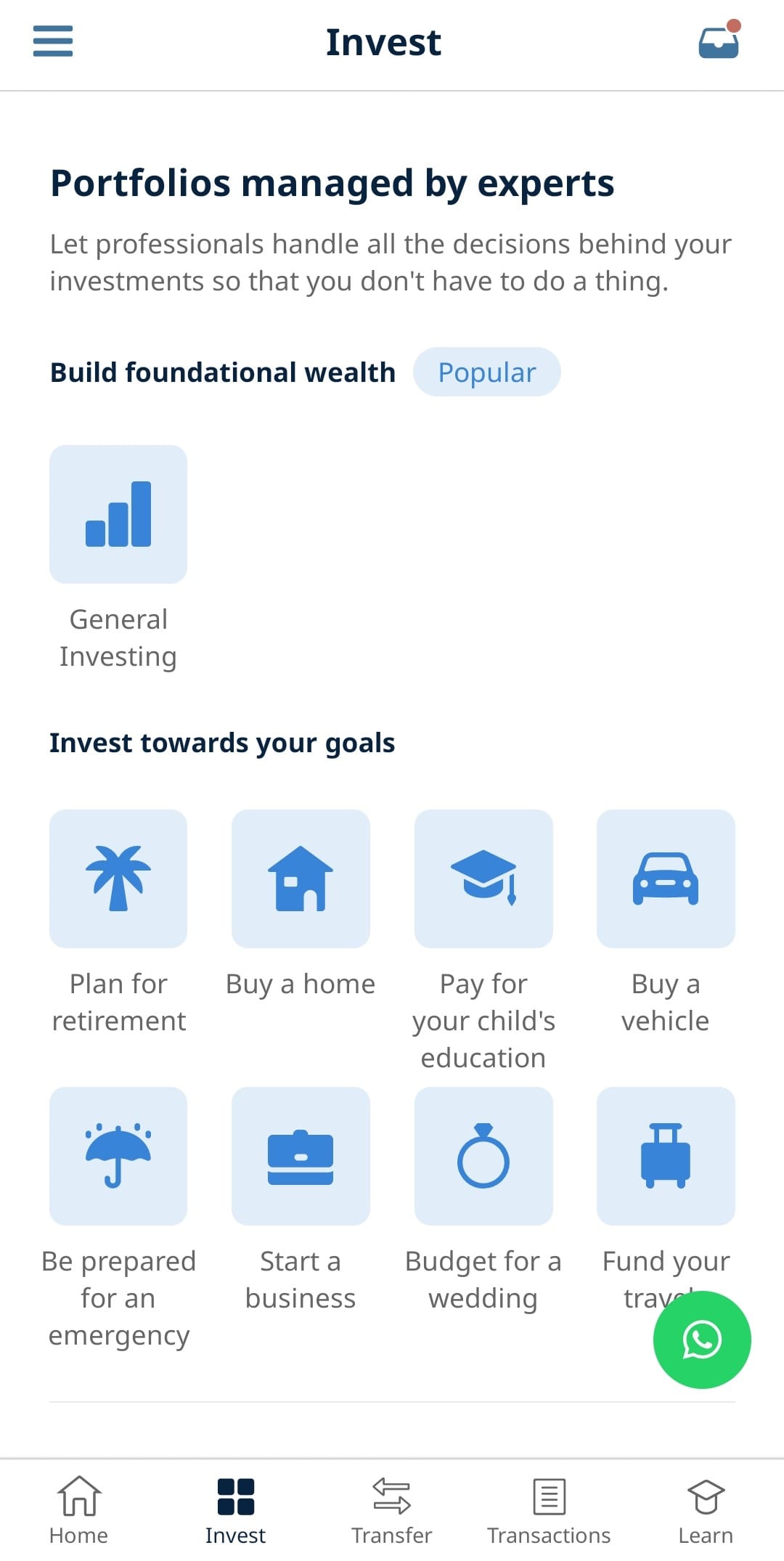

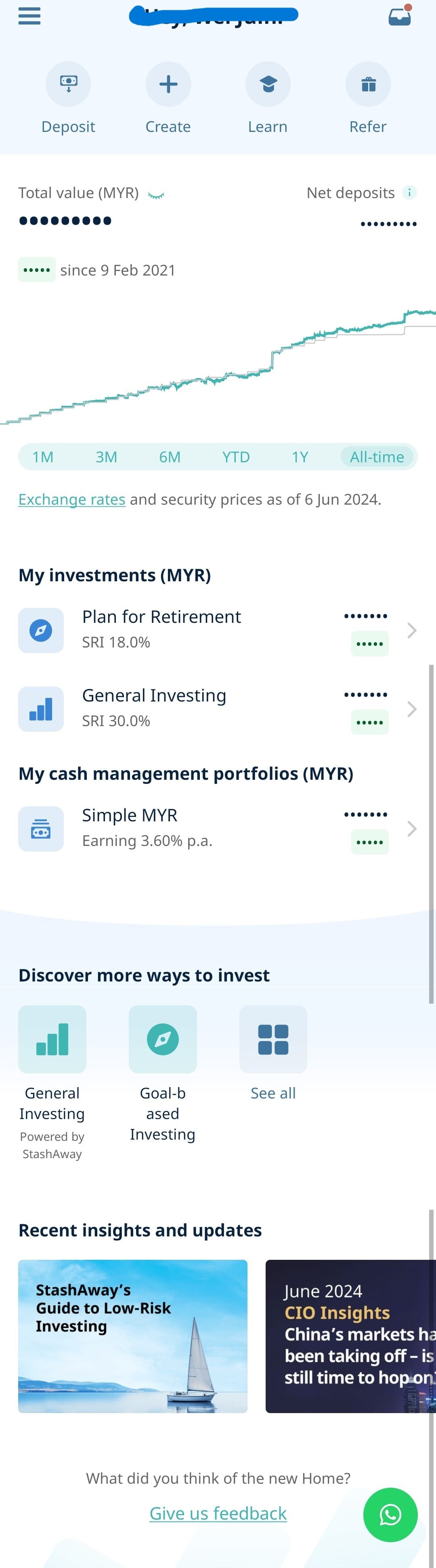

2.Stashaway (Malaysia, Singapore)

This licensed digital investment app, regulated by the Securities Commission of Malaysia, was recommended by my partner and my friends. Fairly simple to use, with intuitive design and great data displays. With investments, it is usually a long term game. Its line chart enables you to observe market trends across time, and yes, there will be ups and downs, depending on the type of risk you take. It is rather interesting to observe this fluctuation, especially when paired with known political or socio-economic events.

"the first robo-advisor in Malaysia to be awarded the Capital Markets License by the Securities Commission under the Digital Investment License framework" - Stashaway website

What's helpful is you don't get bombarded with emails from them all the time, as most of the information is already on their app. Therefore, less noise.

They also provide some helpful videos under their 'Academy' section if you'd like to upskill yourself on relevant financial knowledge.

Stashaway app screenshots

Stashaway app 'Academy' section

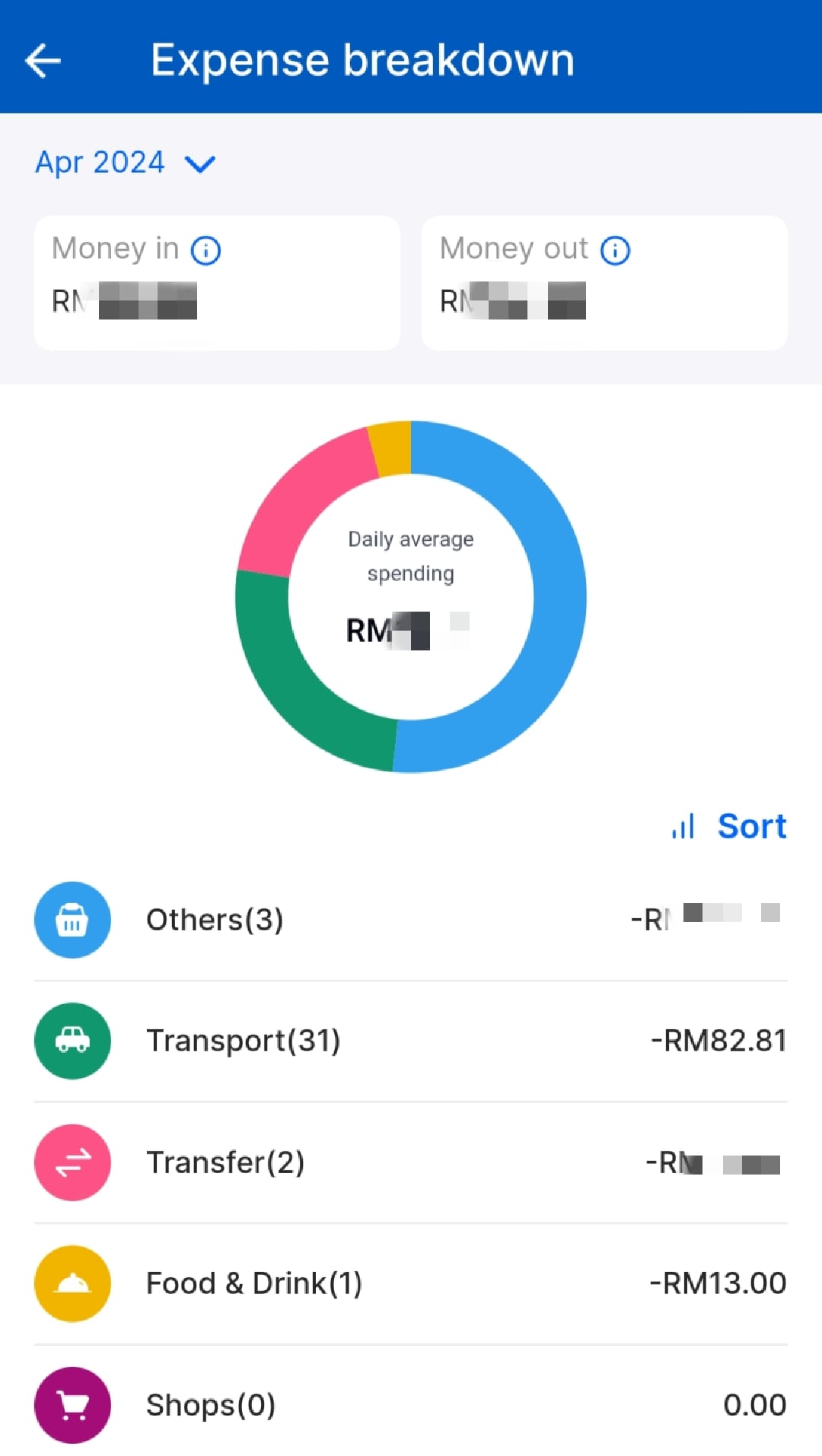

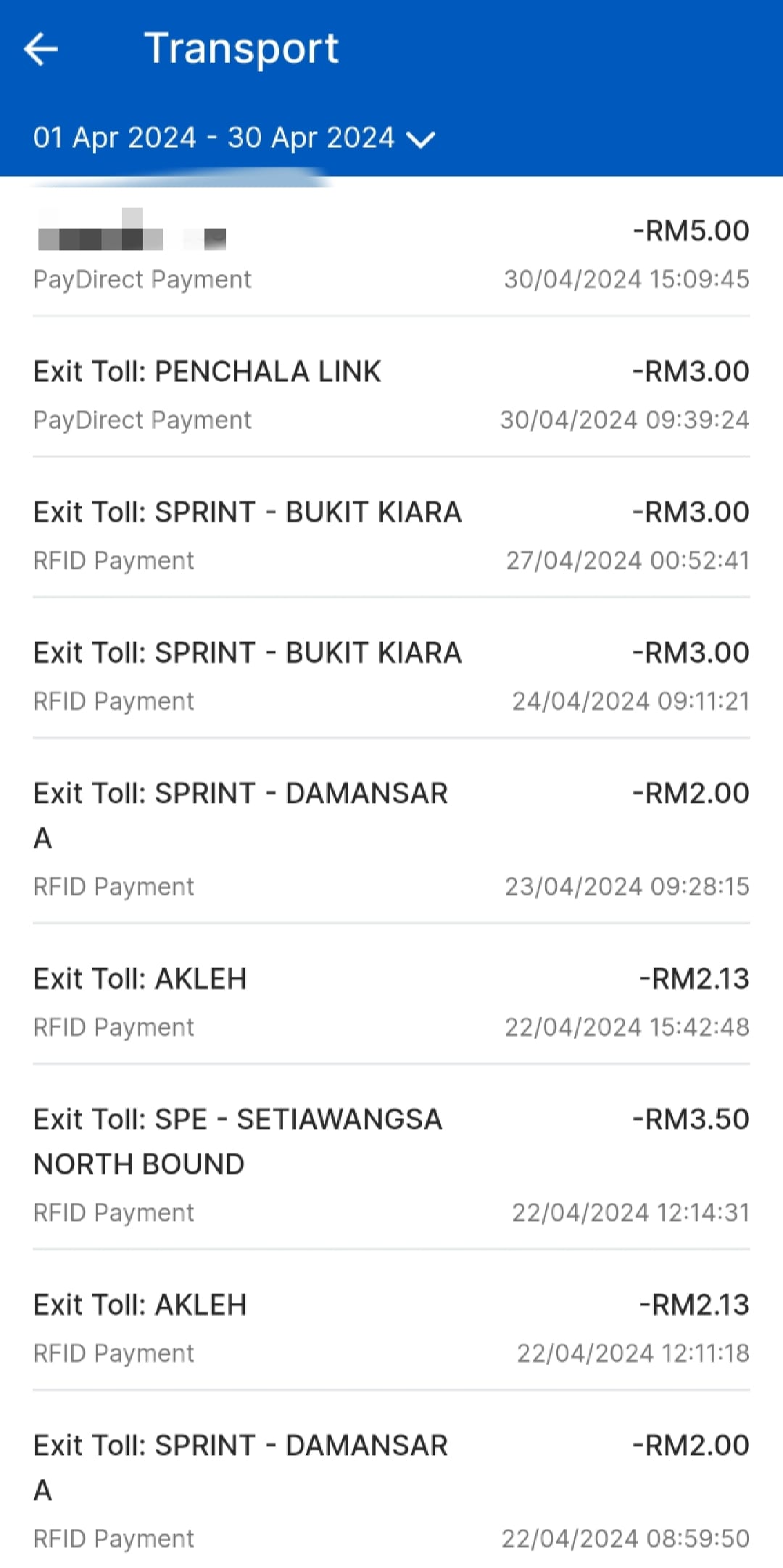

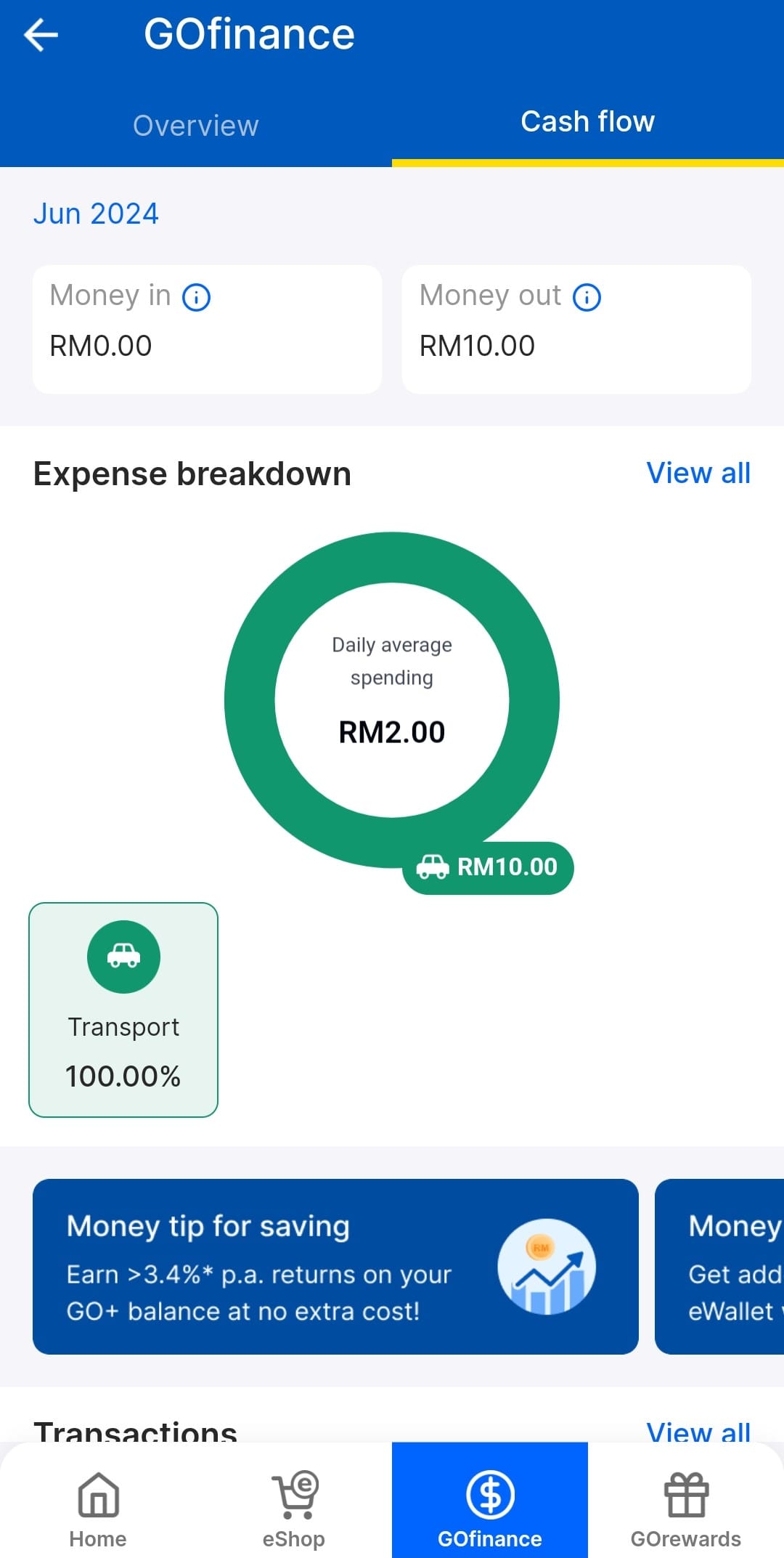

3.Touch 'n Go App (Malaysia)

Born from a simple contactless card for highway tolls and public transportation way back in 1997, now this brand has expanded into a full-blown fintech service. Offering a multitude of services such as QR payment, investing, e-wallet, it is marketed as a go-to financial app for both local and foreigners in Malaysia. They can rightfully claim that they are among the pioneers leading the transformation towards a cashless society in the country.

Built on the tenet of increasing financial inclusion across Malaysia,...

Their latest feature shows you your expense breakdown, allowing you to observe your own spending habits, and interestingly, even your travelling routines (as they did start of as a transport mobility service).

IMO, one of the biggest advantage of this app is their investment features, enabling their users to easily diversify their investments with guided information and also track existing investment that's been done through any national banks. With this, you can track your spending and investments all in one app. The only one missing is accessing all your bank transactions. LOL

MAE by Maybank2u

I'm not a user of MAE by Maybank2u, but it does track your spending too and that sounds like a promising app to own! Read more HERE.

Consolidate them please!

Scattered expenses across multiple apps is not very helpful actually. Hence, I'd love to see our banking apps consolidating and charting our expenses for personalised financial awareness.

As a consumer, where do I to start?

Did you know that there are global and national frameworks that states the core competencies for financial literacy? Skimming through it, I realised I have much to learn! Many of us have to learn things the hard way and I truly wish to see more initiatives to right misconceptions and guide us to be smarter in handling our finances in both the short and the long term.

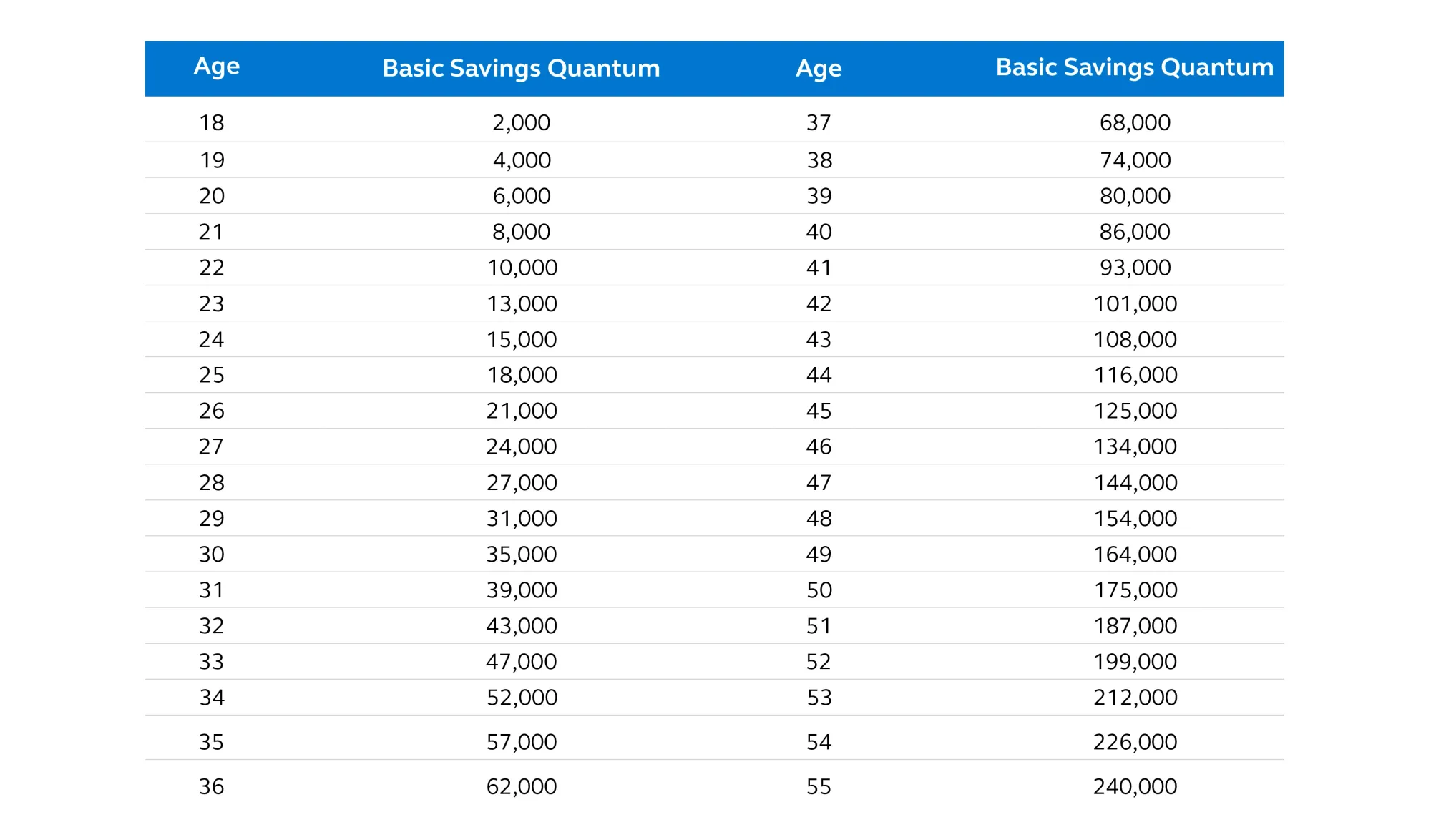

To end, let's just start with what most, if not all, people would know how to do, SAVE. Did you know that our EPF provided a benchmark for the bare minimum amount you should retire with? READ HERE. There's also a breakdown of minimum savings you should have at different stages in your life. This table from Principal (in alliance with CIMB) breaks it down by age for Malaysian.

Knowing the end goal will help one figure out how to get there. Once we know where, or in this case how much we need to have to retire comfortably, then we can start looking at our current situation and backwards plan. Do bear in mind as currency inflates and fluctuates in value, this number may (most probably) go up across time. So if you can afford to save more, do so.